Mortgage Rates Today: Current Trends & 2026 Forecast (Should You Buy or Wait?)

TL;DR: Checking mortgage rates today? As of early 2026, rates are showing signs of stabilization after last year’s volatility. While the 30-year fixed rate remains higher than pre-pandemic levels, experts predict a slight dip later this year. If your credit score is above 760, you hold the power to negotiate. Read on to analyze if locking in a rate now is your best financial move.

Introduction

For anyone looking to buy a home, the most critical number isn’t the price of the house—it is the interest rate. Mortgage rates today dictate your monthly payment and your overall buying power. A difference of just 1% can cost (or save) you tens of thousands of dollars over the life of a loan.

We are currently in a unique economic environment in 2026. Inflation is cooling, but the Federal Reserve is still cautious. This leaves homebuyers asking one burning question: “Should I buy now, or wait for rates to drop?”

In this comprehensive market update, we will break down mortgage rates today, analyze the forecast for the rest of 2026, and give you actionable strategies to secure the lowest possible rate from lenders.

Current Mortgage Rate Breakdown (2026 Update)

To understand where we are, we have to look at the numbers. Mortgage rates today vary significantly based on the loan type. Here is what the current landscape looks like for borrowers with good credit.

1. 30-Year Fixed-Rate Mortgage

This is the most popular loan in America. Your rate stays the same for 30 years.

- Current Trend: Rates are hovering in a stable range. They are not historically low, but they are off their recent peaks.

- Who it is for: Buyers who plan to stay in their home for 7+ years and want a predictable monthly payment.

2. 15-Year Fixed-Rate Mortgage

- Current Trend: Typically, these rates are 0.5% to 1% lower than the 30-year fixed option.

- The Trade-off: Your monthly payment is higher because you are paying off the loan faster, but you save massive amounts in interest.

3. Adjustable-Rate Mortgages (ARM)

- Current Trend: ARMs are becoming popular again as mortgage rates today remain elevated.

- Risk Factor: You might get a lower introductory rate for 5 years, but after that, the rate can go up. This is risky if you don’t plan to sell or refinance before the rate adjusts.

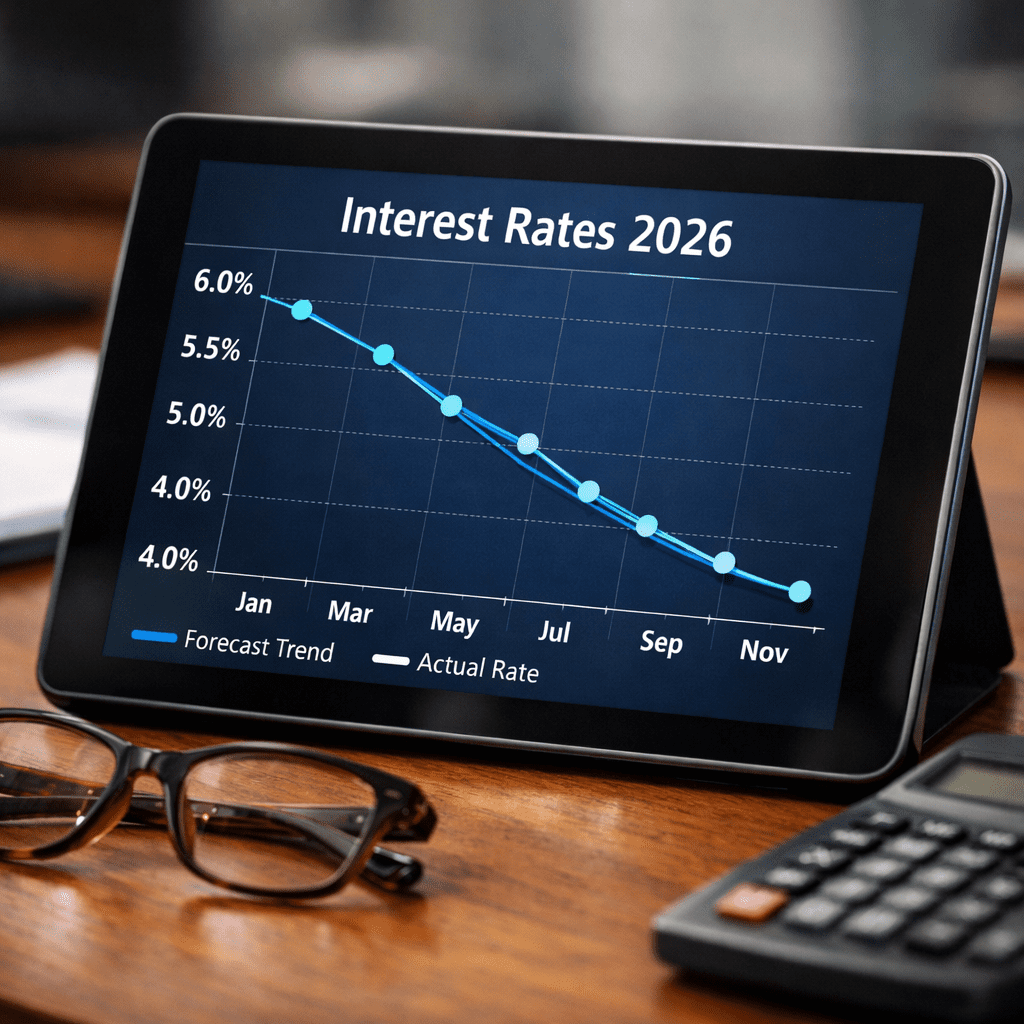

Mortgage Rate Forecast: What Will Happen in 2026?

No one has a crystal ball, but financial indicators give us clues. Analyzing mortgage rates today alongside inflation data suggests a few scenarios for the rest of 2026.

The “Soft Landing” Scenario

If inflation continues to drop near the Fed’s 2% target, we could see mortgage rates slowly decline throughout the year. This is the most optimistic scenario for buyers.

The “Sticky Inflation” Scenario

If the economy remains too hot and prices stay high, the Federal Reserve may keep interest rates high. In this case, mortgage rates today could remain flat or even tick up slightly.

Expert Opinion: Most housing economists believe we will not see 3% rates again anytime soon. The “new normal” is likely in the mid-range. Waiting for a massive crash in rates might mean waiting indefinitely.

5 Factors That Influence Your Mortgage Rate

You cannot control the Federal Reserve, but you can control your personal financial profile. When you check mortgage rates today, remember that the advertised rate isn’t always the rate you will get.

1. Your Credit Score

This is the single biggest factor.

- Score 760+: You get the “Prime” rate (the lowest advertised).

- Score 620-640: You might pay 0.5% to 1% higher than someone with excellent credit.

- Action: Before applying, pay down credit card balances to boost your score.

2. Down Payment Amount

Lenders love safety. If you put 20% down, you are less risky than someone putting 3% down. A higher down payment often unlocks a lower interest rate.

3. Loan Type and Term

Shorter loans (15-year) have lower rates than longer loans (30-year). Government-backed loans (FHA, VA) often have lower rates than conventional loans but come with extra fees like mortgage insurance.

4. The Bond Market

Mortgage rates today are closely tied to the 10-Year Treasury Yield. When bond yields go up, mortgage rates usually follow. If you see news that “Bond yields are falling,” it is a good day to lock in a rate.

5. Inflation

Mortgage lenders hate inflation because it devalues the money you pay back to them. High inflation leads to high mortgage rates. As inflation cools in 2026, rates should become more attractive.

How to Get the Best Mortgage Rate Today

Don’t just walk into your local bank and sign the first paper they give you. Follow these steps to win the rate game.

Shop Around (The Rule of 3)

Studies show that borrowers who get quotes from at least three different lenders save an average of $3,000 over the life of the loan. Compare:

- Your local bank/credit union.

- An online lender.

- A mortgage broker.

Consider “Buying Down” the Rate

If mortgage rates today are too high for your budget, ask about “Discount Points.” This is where you pay an upfront fee (usually 1% of the loan amount) to lower your interest rate by 0.25%. If you plan to live in the house forever, this math often works in your favor.

Lock It In

Rates change daily, sometimes hourly. Once you find a rate you are happy with, ask your lender to “Lock” it. This protects you if rates jump up before your closing date.

Is Now a Good Time to Buy a House?

This is the million-dollar question. With mortgage rates today being where they are, affordability is a challenge.

The Case for Buying Now

- Less Competition: High rates scare away many buyers. You might face fewer bidding wars.

- Refinance Later: There is a saying in real estate: “Marry the house, date the rate.” You can buy now to secure the home, and if rates drop next year, you can refinance to a lower rate.

The Case for Waiting

- Inventory: If housing inventory increases later in 2026, prices might soften.

- Savings: Waiting gives you more time to save for a larger down payment, which helps offset high rates.

Conclusion

Understanding mortgage rates today is essential for making a smart real estate decision in 2026. While the days of ultra-cheap money are behind us, homeownership remains the best way to build long-term wealth.

Don’t obsess over daily fluctuations. Focus on your budget, improve your credit score, and shop multiple lenders. If the monthly payment fits your budget comfortably, don’t let the fear of rates stop you from finding your dream home.

FAQs

Will mortgage rates go down in 2026?

Most analysts predict a gradual decrease or stabilization in mortgage rates for 2026 as inflation comes under control. However, a return to the 3% rates of 2020-2021 is highly unlikely in the near future.

How often do mortgage rates change?

Mortgage rates change every single day the stock market is open. They can even change multiple times within the same day based on economic news reports (like jobs reports or CPI data).

What credit score do I need for the best mortgage rate?

To get the absolute best mortgage rates today, you typically need a FICO credit score of 760 or higher. However, you can still get a competitive rate with a score of 700-740.

Should I lock my mortgage rate today?

If you are closing on a house within the next 30-45 days and you are comfortable with the payment, it is usually wise to lock your rate. Gambling that rates will drop in the short term is risky.

F8bet5ceo seems like a solid option. I like the look of the site, clean and easy. Hope their customer support is good too! Give them visit, follow this link f8bet5ceo