15 Genius Frugal Living Hacks to Save You $500+ Every Month (The Ultimate 2026 Guide to Financial Freedom)

Introduction

In an era of rising inflation and skyrocketing costs of living in the US, finding ways to keep more of your hard-earned money has become a necessity rather than a choice. Adopting frugal living hacks isn’t about being “cheap”; it’s about being intentional with your spending so you can afford the things that truly matter. Whether you want to pay off debt, save for a house, or simply reduce financial stress, mastering these strategies can change your life.

The Power of Intentional Spending

The journey to financial independence starts with a mindset shift. By implementing simple yet effective frugal living hacks, the average American household can easily save upwards of $500 every month. It’s the small, daily decisions—where you shop, how you eat, and how you manage your home—that compound into massive savings over time.

1.Master the Art of Meal Planning

One of the most impactful frugal living hacks involves taking control of your kitchen. Americans spend thousands of dollars annually on takeout and forgotten groceries that rot in the fridge. By spending just 30 minutes every Sunday planning your meals for the week, you can slash your food budget by 40%. Always shop with a list and stick to it to avoid impulse buys. Before diving into specific savings, it’s essential to understand the 50/30/20 budgeting rule to manage your monthly income effectively.”

2.Embrace the “No-Spend” Weekend Challenge

If you find your bank account draining every Friday to Sunday, try a “No-Spend” weekend. This is one of those frugal living hacks that turns saving into a game. Instead of going to expensive movies or dinners, explore free local parks, host a board game night, or declutter your home. You’ll be surprised how much fun you can have without touching your credit card.

3.Cut the Cord and Audit Your Subscriptions

Are you still paying for a $150 cable package or three different streaming services you barely watch? A high-ROI frugal living hacks strategy is to perform a monthly subscription audit. Cancel everything you haven’t used in the last 30 days. Switching to a single streaming service or using free resources like the local library for movies and books can save you over $1000 a year.

4. Shop Second-Hand First

Before buying anything new—whether it’s furniture, clothes, or kitchen gadgets—check second-hand marketplaces. Utilizing platforms like Facebook Marketplace, Poshmark, or local Thrift Stores is a cornerstone of frugal living hacks. You can often find high-quality, name-brand items for 70-90% off the retail price, keeping your home stylish without the “new” price tag.

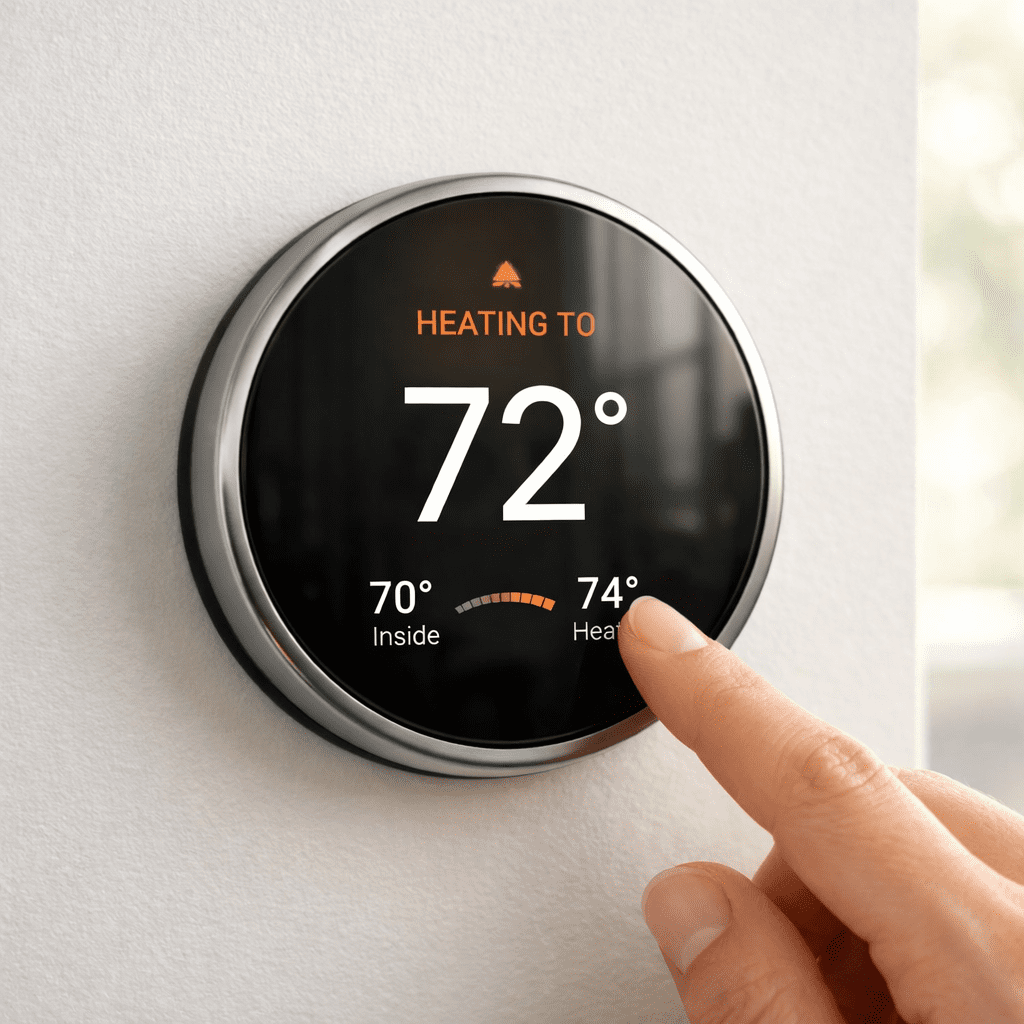

5. Optimize Your Home’s Energy Efficiency

Your utility bills are often higher than they need to be. Simple frugal living hacks like installing a programmable thermostat, sealing window leaks with weatherstripping, and switching to LED bulbs can significantly lower your monthly expenses. In the US, heating and cooling are the biggest energy hogs; adjusting your thermostat by just 2 degrees can save you a bundle.

6.Use the 24-Hour Rule for Impulse Buys

Marketing in the US is designed to make you buy now. To combat this, one of the best psychological frugal living hacks is the 24-hour rule. If you see something you want (but don’t need), wait exactly 24 hours before purchasing. Most of the time, the “urge” will pass, and you’ll realize you didn’t really need the item, saving you hundreds of dollars in “scroll-and-click” shopping.

7. DIY Your Household Cleaners

Stop paying $5-$8 for a bottle of chemical-heavy cleaners. A classic among frugal living hacks is making your own cleaning solutions using vinegar, baking soda, and lemon. Not only is this better for the environment and your health, but it also costs pennies per bottle. It’s a small change that adds up to big savings over a year.

8. Leverage Cashback and Rewards Apps

If you have to spend money, make sure you get some of it back. Using apps like Ibotta, Rakuten, or Fetch Rewards is a smart way to implement frugal living hacks into your routine. By scanning receipts or shopping through these portals, you can earn cash back on everyday purchases like groceries and gas, which can be used to fund your holiday savings.

9. The “Generic Brand” Switch

Many people are loyal to name brands out of habit, but in many cases, the ingredients in generic or store-brand products are identical. Making the switch to store brands for staples like flour, sugar, medicine, and cleaning supplies is one of the easiest frugal living hacks to implement immediately. You’ll see the difference in your bank account, but not in the quality of the products.

10. Maintenance Over Replacement

In our “throwaway” culture, we often replace things the moment they break. However, learning basic repair skills is a vital part of frugal living hacks. Whether it’s sewing a button, fixing a leaky faucet, or maintaining your car’s oil changes on time, taking care of what you own prevents expensive emergency replacements down the road. Managing your debts properly not only saves you money on interest but also helps you improve your credit score for future investments.

11. Declutter for Cash

Frugality isn’t just about spending less; it’s also about managing what you have. A great frugal living hacks practice is to declutter your home once a season and sell items you no longer use. Selling old electronics, clothes, or tools on eBay or Mercari provides an instant cash infusion that can be used to build your emergency fund.

12. Drink More Water and Brew Your Own Coffee

The “Latte Factor” is real. Spending $5-$7 a day at Starbucks adds up to over $150 a month. By brewing your coffee at home and carrying a reusable water bottle, you are practicing essential frugal living hacks. Not only will you save a massive amount of money, but you’ll also reduce your plastic waste.

13. Cancel Your Gym Membership for Nature

If you aren’t a hardcore bodybuilder, do you really need a $50/month gym membership? Many frugal living hacks enthusiasts prefer “prison workouts,” running in local parks, or following free high-quality workout videos on YouTube. Your body won’t know the difference between a $100 dumbbell and a gallon of water, but your wallet will.

14. Use the Library for Everything

The US public library system is a gold mine for those following frugal living hacks. Beyond just books, many libraries offer free access to digital magazines, high-end software, museum passes, and even “Libraries of Things” where you can borrow tools or kitchen appliances. It is the ultimate resource for free entertainment and education.

15. Automate Your Savings

Finally, the most effective of all frugal living hacks is to pay yourself first. Set up an automatic transfer from your checking to your savings account the day you get paid. If the money isn’t in your checking account, you won’t spend it. This ensures that your frugal efforts actually result in long-term wealth building.

Conclusion: Your Journey Starts Today

Adopting these frugal living hacks doesn’t mean your life becomes boring. It means you are taking control of your future. By being mindful and making these small adjustments, you can easily save $500 or more every single month. Start with just two or three of these frugal living hacks today and watch your financial stress melt away.

Frequently Asked Questions (FAQs)

Q1: What is the most effective way to start frugal living?

Ans: The best way to start is by tracking your expenses for 30 days. Most people realize they spend a significant amount on small, unnecessary items. Once you identify these “money leaks,” you can apply frugal living hacks like meal planning and cutting unused subscriptions to see immediate results.

Q2: Can frugal living hacks really save me $500 a month?

Ans: Absolutely! For an average American household, saving $500 is very realistic. For example, switching from daily Starbucks to home-brewed coffee saves ~$150, meal prepping saves ~$200, and auditing utility bills/subscriptions can easily save another ~$150. These small frugal living hacks add up quickly.

Q3: Is frugal living the same as being cheap?

Ans: No, there is a big difference. Being “cheap” is about spending the least amount of money regardless of quality. “Frugal living” is about being smart and intentional. It’s about using frugal living hacks to cut costs on things that don’t matter so you can afford high-quality things that do.

Q4: How can I save money on groceries without using coupons?

Ans: While coupons are great, you can save more by shopping for store brands (generic), buying in bulk, and choosing seasonal produce. These frugal living hacks often provide more consistent savings than searching for individual coupons.

Q5: What are the best frugal living hacks for beginners?

Ans: For beginners, the best hacks are the “24-Hour Rule” for impulse buys, brewing your own coffee, and using the local library for free entertainment. These require very little effort but provide a great psychological boost to keep you motivated on your financial journey.