Decoding the Unpredictable Bitcoin Market Dynamics: Analyzing the Steep Bitcoin Price Slide and the Looming Shadow of BTC ETF Impact.

The Recent Bitcoin Price Slide: Tracing the Weekend Downturn

The cryptocurrency market recently witnessed a sharp and significant Bitcoin Price Slide, capturing the attention of investors worldwide. This massive plunge was not merely a statistical anomaly; it was a profound reflection of the overall market sentiment and the highly leveraged nature of current Bitcoin Market Dynamics. Our deep analysis confirms that this weekend downturn efficiently liquidated hundreds of millions of dollars in leveraged long positions across major exchanges, fundamentally altering the existing Bitcoin Market Dynamics.

This aggressive cleansing of leveraged positions was the primary catalyst for the dramatic fall. While such volatility is painful for short-term investors, history suggests that these corrections often create a healthier, more stable foundation for a future recovery, which is a classic feature of current Bitcoin Market Dynamics. Understanding the intensity and root cause of the latest Bitcoin Price Slide is crucial for deciphering broader trends in the Bitcoin Market Dynamics.

From a technical analysis perspective, the correction has tested several critical support levels, particularly those situated around the US86,000toUS79,600 range. Failing to hold these key psychological and technical barriers could potentially lead to further downside, perhaps testing the US$67,700 level, which would signify a sustained shift in the bearish aspects of Bitcoin Market Dynamics. Monitoring these support and resistance levels is vital for predicting the next move in Bitcoin Market Dynamics.

Interestingly, despite the downward pressure, the aggregate Open Interest in Bitcoin derivatives slightly increased, peaking above the US$57 billion mark. This rise in Open Interest, even amidst a significant Bitcoin Price Slide, suggests that new leveraged positions are being actively opened, indicating sustained trader interest and high risk appetite within the complex Bitcoin Market Dynamics. This behavior confirms that the market views the correction as a potential buying opportunity rather than a systemic failure of Bitcoin Market Dynamics.

The extreme speed of the recent Bitcoin Price Slide caught many unprepared, highlighting the need for robust risk management strategies when navigating the volatile landscape of Bitcoin Market Dynamics. The resilience of the market structure post-plunge provides an optimistic signal that underlying demand remains strong, which is a key component when evaluating the short-term stability of Bitcoin Market Dynamics.

BTC ETF Impact and Institutional Shifts in Bitcoin Market Dynamics

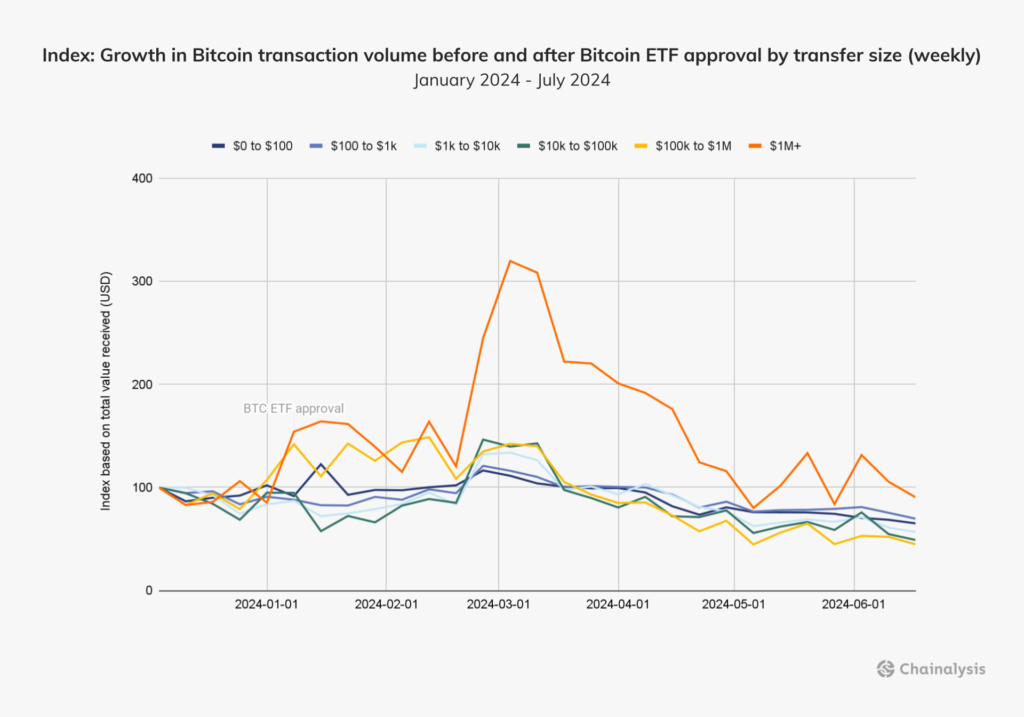

The highly anticipated, and in some jurisdictions, already approved, Bitcoin Exchange-Traded Fund (ETF) remains a defining, macro factor in the ongoing evolution of Bitcoin Market Dynamics. The intense focus from major institutional finance firms, such as Goldman Sachs, on the finalized ETF product reflects the surging institutional interest and commitment to legitimizing the asset class, which drastically influences Bitcoin Market Dynamics. This institutional embrace is a central theme when discussing the massive potential BTC ETF Impact.

A successful BTC ETF Impact is expected to unlock Bitcoin for a far wider audience of traditional investors who are currently restricted from holding the physical asset. By allowing investors to gain exposure to Bitcoin’s price movements without directly managing custody, the ETF structure creates a frictionless path for capital inflow, which provides long-term, structural support to Bitcoin Market Dynamics. This sustained institutional flow is precisely what analysts predict will revolutionize long-term Bitcoin Market Dynamics.

Conversely, certain underlying risks must be acknowledged. For example, observations regarding stablecoins like Tether suggest their Bitcoin holdings may have exceeded the necessary limits to absorb sudden volatility. If a rapid, large-scale Bitcoin Price Slide occurs, this raises the risk of the token becoming undercollateralized, introducing an internal risk that directly counteracts the external optimism generated by the potential BTC ETF Impact. These contrasting forces create unpredictable Bitcoin Market Dynamics.

The entry of players like Goldman Sachs, regardless of the immediate Bitcoin Price Slide, indicates a definitive move toward a more mature and professional investment environment for cryptocurrency. This professionalization of the investment ecosystem is widely viewed as a strongly positive long-term signal for the stability and growth potential of Bitcoin Market Dynamics. The regulatory implications of the BTC ETF Impact cannot be overstated in shaping future Bitcoin Market Dynamics.

Technical analysis reveals that the Relative Strength Index (RSI) touched levels indicative of deeply oversold territory immediately following the downturn. This technical condition often signals that selling pressure is reaching exhaustion, potentially setting the stage for a short-term rebound if key support levels hold. This technical setup, combined with the structural changes from the potential BTC ETF Impact, creates a complex scenario for predicting immediate Bitcoin Market Dynamics. Therefore, understanding the interplay between traditional technical analysis and the new institutional landscape is paramount for mastering Bitcoin Market Dynamics.

Altcoin Performance and the Domino Effect of Bitcoin Price Slide

The dramatic Bitcoin Price Slide inevitably generated significant fallout across the entire altcoin market, resulting in a synchronized downturn in prices for almost all major cryptocurrencies. During this recent correction, Ethereum (ETH), the flagship altcoin, experienced a notable percentage decline, with its value momentarily settling near lower support thresholds. This broad decline provides clear evidence of how closely linked the overall market sentiment is to the prevailing Bitcoin Market Dynamics.

Other major altcoins, including XRP and Solana (SOL), also registered substantial percentage losses over the same 24-hour period. Solana, despite its architectural advantages known for high transaction throughput and fast settlement times, could not escape the gravitational pull of the wider Bitcoin Price Slide. This confirms the narrative that, regardless of individual technological merit, market sentiment and liquidity are overwhelmingly dictated by the dominant Bitcoin Market Dynamics.

It is important to note, however, that even amidst the widespread decline, certain altcoins continued to capture attention based on their unique technological developments and use cases. For instance, Ethereum, the pioneering blockchain for smart contract functionality, consistently focused on strengthening its core ecosystem through continuous upgrades, illustrating a fundamental strength often masked by short-term Bitcoin Price Slide events. Such technological resilience is a crucial variable in long-term Bitcoin Market Dynamics.

Binance Coin (BNB), benefiting from its position within the high-volume exchange ecosystem, often displays comparative resilience due to its utility for reducing trading fees and participating in new launchpads. This utility-driven demand can help cushion the impact of a sharp Bitcoin Price Slide and potentially lead to a quicker recovery relative to coins lacking an immediate, high-volume use case, showcasing unique aspects of its Bitcoin Market Dynamics. Conversely, certain altcoins facing internal legal or regulatory challenges may feel magnified pressure during a general market downturn driven by overall Bitcoin Market Dynamics.

A thorough Bitcoin Market Dynamics analysis shows that while the initial impulse of a decline originates with BTC, the extent of the altcoin correction is often determined by its individual liquidation levels and outstanding leverage. The speed with which certain Layer 1 chains, like Solana, rebounded following the immediate shock of the Bitcoin Price Slide highlights their strong underlying community and ongoing developer commitment, differentiating their specific recovery path within the overall Bitcoin Market Dynamics. Therefore, investors must differentiate between fear-driven selling associated with the Bitcoin Price Slide and actual fundamental weakness when assessing their positions in the current Bitcoin Market Dynamics.

The Role of Derivatives and Future Bitcoin Market Dynamics

The data originating from the derivatives market provides perhaps the most forward-looking indicators for the immediate future of Bitcoin Market Dynamics following any significant price event, such as the recent Bitcoin Price Slide. While initial Open Interest figures showed a slight rebound, the Funding Rate—a key metric reflecting the cost of holding a long position—settled into a mildly negative value. This slight negative Funding Rate is a telltale sign of a gentle, not panicked, bearish sentiment, which is characteristic of a healthy correction rather than a complete collapse of Bitcoin Market Dynamics.

Analyzing this data helps to confirm the underlying strength of Bitcoin Market Dynamics. Following the aggressive liquidation of overleveraged positions, the market typically seeks a ‘clean slate,’ effectively washing out the riskier players. This deleveraging process is generally considered healthy for the long-term sustainability of the asset, even though it is the direct cause of the short-term Bitcoin Price Slide.

If the identified key support levels manage to hold firm against renewed selling pressure, the confluence of the deeply oversold RSI conditions and the deleveraged market structure creates a robust technical foundation for a near-term price bounce. This potential short-term reversal is a scenario highly anticipated by active traders and algorithmic strategies that constantly monitor the subtle shifts in Bitcoin Market Dynamics. Institutional players are keenly focused on these technical indicators, using them to pinpoint optimal entry and exit points within the highly volatile Bitcoin Market Dynamics.

A significant structural question revolves around how the anticipated BTC ETF Impact might alter the fundamental operation of the derivatives market. Should an ETF effectively introduce significant, non-leveraged institutional liquidity directly into the spot market, it could potentially dampen the extreme volatility often associated with the futures and options markets. Understanding this critical interrelationship between spot-market institutionalization and derivatives behavior is an essential element of any comprehensive Bitcoin Market Dynamics research. Such a shift could lead to more stable, predictable Bitcoin Market Dynamics.

The data conclusively suggests that the market structure, particularly evidenced by the derivatives data, indicates that generalized fear and panic did not fully dominate the trading environment immediately following the plunge. This resilience points to a healthy degree of maturity in the current Bitcoin Market Dynamics. The behavior of the derivatives market over the coming weeks will be a crucial determinant, signaling whether the recent Bitcoin Price Slide was merely a transient corrective event or the beginning of a more sustained downtrend. Consequently, traders must prioritize understanding these complex interactions to navigate the highly nuanced Bitcoin Market Dynamics.

Regulatory Headwinds and the BTC ETF Impact on Global Adoption

Regulatory certainty remains arguably the most critical and unresolved issue profoundly influencing both the Bitcoin Market Dynamics and the potential long-term BTC ETF Impact. The entrance of sophisticated financial firms into the cryptocurrency services sector naturally attracts intense scrutiny from global financial regulators. Any positive regulatory signals and speculation regarding favorable monetary policy from institutions like the Federal Reserve are often cited as major catalysts capable of propelling Bitcoin back toward previous highs.

Such regulatory optimism is the single largest positive external factor for maximizing the BTC ETF Impact. Successful approval and widespread rollout of ETFs in major global markets would effectively legitimize cryptocurrency as a mainstream, institutional-grade asset class. This would not only mitigate the risk of future, severe Bitcoin Price Slide events but also accelerate the pace of global adoption across diverse investor demographics. The clear structure of an ETF simplifies tax and compliance issues, which is a major benefit to the Bitcoin Market Dynamics.

On the flip side, ongoing regulatory disputes, particularly those involving key stablecoin issuers, continue to generate uncertainty regarding the future framework of Bitcoin Market Dynamics. Resolving these contentious regulatory issues is absolutely paramount to achieving true market stability. Uncertainty breeds caution, and caution can often be a drag on positive price momentum within the highly sensitive Bitcoin Market Dynamics.

The demonstrated price recovery following the initial shock of the Bitcoin Price Slide underscores the fact that the market is acutely sensitive to external factors, including regulatory news and broader macroeconomic forecasts, beyond mere technical indicators. The expectation of a favorable, clear regulatory environment can quickly override the negative effects of a major Bitcoin Price Slide, highlighting the dominance of sentiment in Bitcoin Market Dynamics.

Governments and central banks globally are currently grappling with the precise manner in which to define, classify, and regulate cryptocurrency. The ultimate decisions made by these governing bodies will have a deep, enduring impact on the potential BTC ETF Impact and, subsequently, the long-term trajectory of Bitcoin Market Dynamics. The clarity provided by a definitive regulatory framework is a necessary prerequisite for the next major bull run in Bitcoin Market Dynamics. Investors globally are now holding their breath, anxiously awaiting pivotal regulatory updates that will shape the very foundation of future Bitcoin Market Dynamics.

Investor Psychology and the Future of Bitcoin Price Slide

Investor psychology plays a disproportionately large role in shaping short-term Bitcoin Market Dynamics, particularly immediately following a significant correction like the recent Bitcoin Price Slide. While technical indicators may strongly suggest a strong rebound is imminent, the process of restoring investor confidence typically takes time and consistent positive price action. The liquidation of highly leveraged positions, which amounted to hundreds of millions, has naturally injected an element of fear and caution into both retail and professional investor segments, a direct influence on the current state of Bitcoin Market Dynamics.

This pervasive fear is often quantifiable through tools like the Fear and Greed Index, which currently reflects a state of extreme caution or outright fear, indicating low investor appetite for risk within current Bitcoin Market Dynamics. This psychological stress generally increases the duration, but not necessarily the severity, of a recovery phase, as investors remain hesitant to commit capital immediately after a Bitcoin Price Slide. The psychological impact is a crucial, non-technical factor in Bitcoin Market Dynamics.

However, the rapid nature of the initial price recovery provides a powerful counterbalance to this caution. The swift bounce back demonstrates Bitcoin’s inherent resilience and confirms the strong presence of dedicated buyers who are poised to accumulate assets at every major dip, reinforcing the robust nature of Bitcoin Market Dynamics. This underlying buying pressure is a crucial factor signaling that the current Bitcoin Price Slide is more likely a healthy market correction than a sustained bearish reversal. The long-term outlook for Bitcoin Market Dynamics remains structurally optimistic, driven by this persistent demand.

The Conclusion

The current Bitcoin Market Dynamics are characterized by high volatility but significant underlying resilience. Despite the recent Bitcoin Price Slide, strong buying behavior and positive regulatory speculation, particularly concerning the BTC ETF Impact, indicate a robust recovery is likely. The long-term future of Bitcoin Market Dynamics will ultimately be determined by successful institutional integration and regulatory clarity.